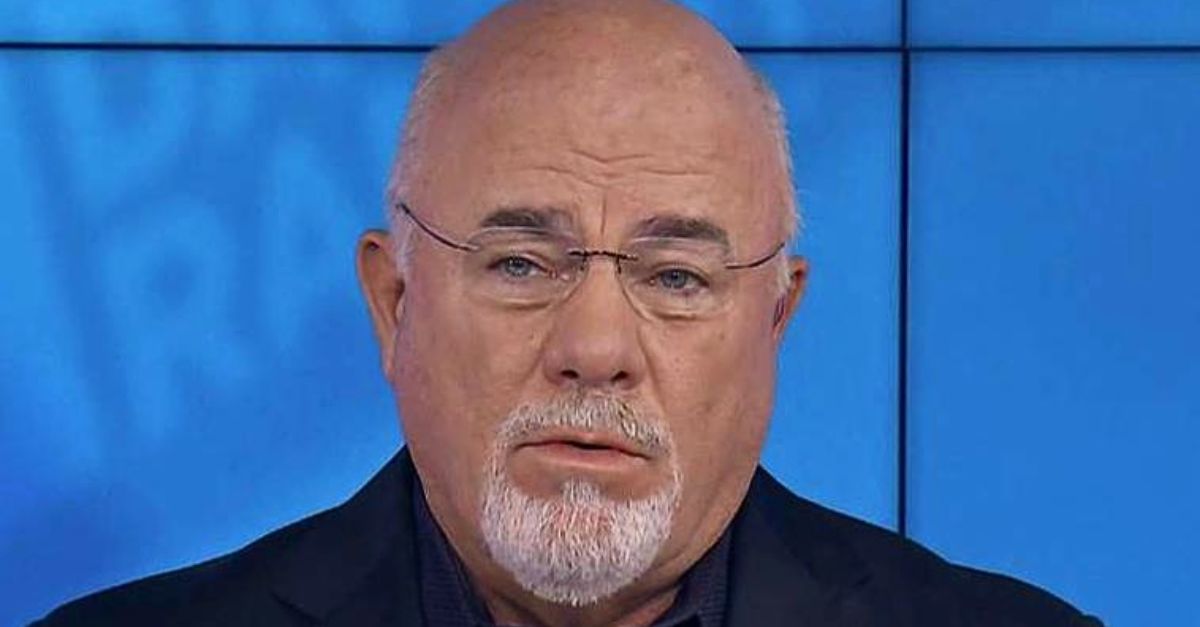

The Hidden Price Of Everyday Comfort

Every swipe, click, and subscription line someone else’s pockets. Dave Ramsey says cutting just a few habits can flip that script—and the rest of this list shows where your cash quietly walks away.

Credit Card Interest

Every time you carry a balance, banks win twice through interest and late fees. The average American could pay thousands in interest alone each year. Those “reward points” barely dent profits. For lenders, compound interest is a goldmine fueled by your minimum payments.

Car Payments That Never End

Stretching loans to seven years doesn’t just buy a car—it buys profit for the lender. Dealers earn from financing kickbacks and insurance add-ons. Americans now owe trillions in auto debt, and this keeps luxury carmakers thriving while owners stay underwater on depreciation.

Dining Out Weekly

Chain restaurants design menus around profit, not value. Soda refills cost them pennies but pad margins by a lot. That quick dinner? It’s structured to upsell combos and cocktails. While you savor convenience, franchise owners enjoy predictable, repeat income streams from your habits.

Impulse Buys From Influencer Links

Affiliate marketing quietly turns your curiosity into someone else’s commission. One click on a “must-have” gadget can yield influencers set percentages per sale. Algorithms time posts for paydays and emotional peaks—so while you scroll, content creators and retailers cash in simultaneously.

Fast Fashion Hauls

Fast fashion is never built on affordability but on turnover. Brands like Shein profit from mass volume, and quality almost always takes a hit. Each $12 shirt might cost under $2 to produce. The real profit comes when trends change weekly, and these just push you to buy, toss, and repeat.

Streaming Subscriptions You Barely Use

Subscription fatigue keeps entertainment giants wealthy. The average US household pays for multiple platforms but regularly uses only two. Companies rely on “set it and forget it” inertia, banking on millions of inactive users who never bother to cancel after the free trial.

Gadget Upgrades Every Year

Smartphone makers roll out incremental changes to trigger FOMO (fear of missing out). Manufacturing costs remain stable while retail prices soar. Each upgrade cycle feeds shareholders, proof that software nudges and marketing outperform true technological leaps.

Convenience Foods

Frozen dinners and ready-to-eat snacks save you time but cost triple in markup. Food giants design packaging to look “healthy” while using cheap filler ingredients. The convenience industry is approximately $805.59 billion globally in 2025, according to recent market research, showing how every microwaved meal quietly fattens corporate margins.

Gunawan Kartapranata, Wikimedia Commons

Gunawan Kartapranata, Wikimedia Commons

Coffee Chains

A latte’s ingredients cost less than a dollar, but branding sells comfort. Chains selling such beverages built empires on the psychology of “daily rituals”. When customers tip generously and return out of habit, corporate profits brew faster than your morning espresso shot.

Lottery Tickets

Lotteries promise dreams but deliver revenue. In the US, states collect billions annually from ticket sales—more than corporate taxes in some regions. The odds of hitting Powerball? One in 292 million. Meanwhile, governments pocket half before prizes even pay out.

Bank Fees

Banks quietly profit from human forgetfulness. Overdraft and maintenance charges bring in billions of dollars each year. Even “free” accounts rely on penalty fees to stay lucrative. Small mistakes—like dipping below a balance threshold—turn into significant profits.

Extended Warranties

Retailers push warranties because they’re nearly all profit. Few buyers ever file claims, and repair costs often fall below coverage prices. In electronics, stores can achieve high margins. That “just-in-case” policy is designed to protect their bottom line, not yours.

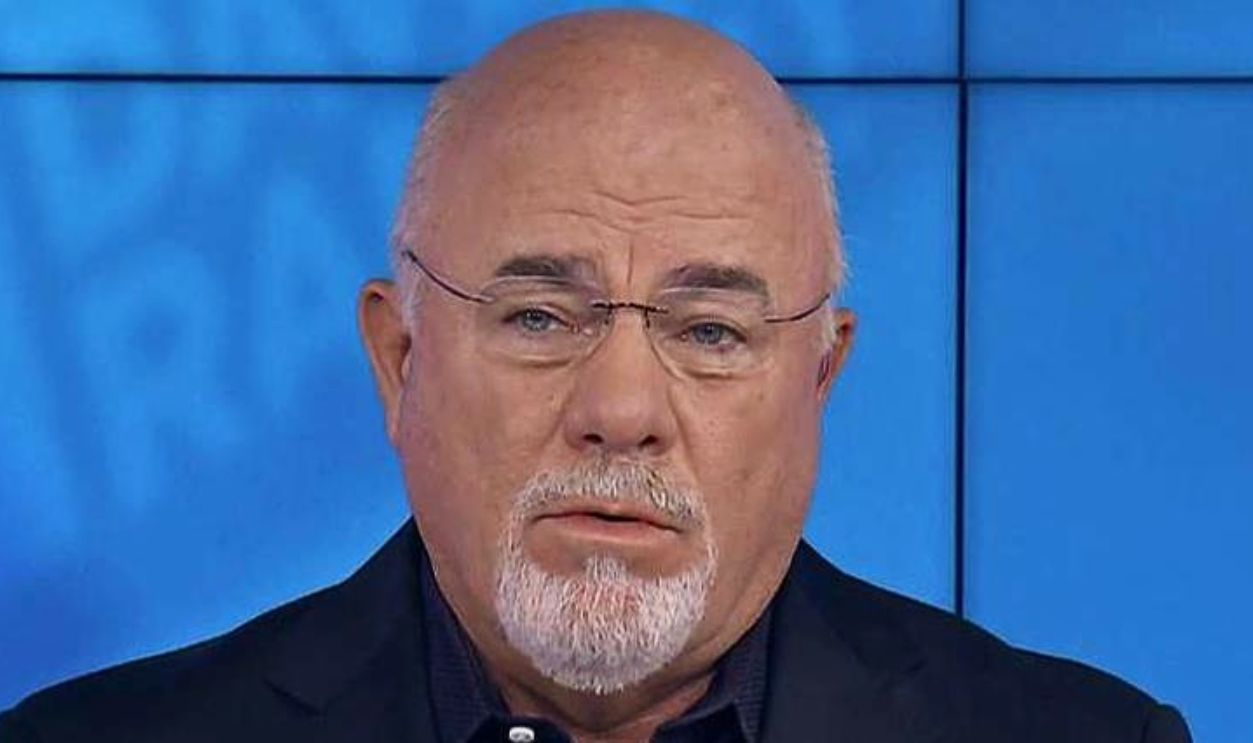

Raimond Spekking, Wikimedia Commons

Raimond Spekking, Wikimedia Commons

Luxury Gym Memberships

Gyms earn by betting against motivation. Attendance peaks in January, then drops by half within weeks. Yet members rarely cancel, locking in passive revenue. For luxury chains, amenities like saunas or lounges cost little to maintain but justify monthly fees that quietly accumulate.

High-Interest Store Cards

Store-branded credit cards promise discounts but hide sky-high APRs. Retailers profit through interest, fees, and loyalty-driven spending. Even unpaid balances help them, since banks share revenue. Each exclusive offer subtly ties your shopping habits to their predictable quarterly growth.

Ajay Suresh from New York, NY, USA, Wikimedia Commons

Ajay Suresh from New York, NY, USA, Wikimedia Commons

Timeshares

Timeshares lure with affordability, but contracts trap owners for years. Annual maintenance fees rise faster than inflation, often exceeding the cost of independent travel. Companies resell the same units repeatedly to earn exponential returns from a single property while buyers struggle to escape the fine print.

Cable Packages

Bundling channels boosts profits by hiding the cost per view. The average subscriber watches fewer than 15 of the hundreds of channels they pay for. Networks negotiate carriage fees, so even unviewed stations earn. That “premium” package mostly funds content you’ll never tune into.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Online Courses Promising Wealth

The self-help education boom minted new millionaires. Courses promising financial freedom often recycle public information. Creators profit from scarcity marketing, not proven success. The over $300 billion e-learning industry thrives because people chase hope, turning inspiration into an evergreen business model.

In-App Game Purchases

Free-to-play games are engineered for impulse. Developers design reward loops that trigger dopamine releases to encourage microtransactions. While one cosmetic upgrade costs a few dollars, millions of small purchases sustain billion-dollar empires like Fortnite and Candy Crush. You buy pixels; they buy yachts.

Branded Bottled Water

Bottled water companies draw from municipal taps, then mark it up thousands of percent. Consumers pay for packaging, marketing, and perception. Despite being identical in quality to tap water, the global bottled water market exceeds $300 billion—turning public resources into private fortunes, one sip at a time.

Influencer Merch

Most influencer apparel is mass-produced with minimal oversight. A hoodie might cost $8; fans pay $60 for branding. Scarcity drops and limited editions drive urgency. The profit margin rivals luxury fashion, all powered by followers’ loyalty and curated online personas.

Subscription Boxes

When you first get monthly boxes, they promise discovery, right? In truth, they’re designed for retention. Companies use algorithms to ship low-cost samples as they charge premium prices. The model thrives on auto-renewals where millions of tiny, predictable profits are disguised as personalized surprise.

Fad Diet Supplements

Diet pills and powders profit from desperation. The global weight-loss supplement market is valued in the billions, yet most products lack clinical evidence. Companies upsell stacks and auto-ship refills, making each resolution cycle a payday. Meanwhile, results rarely last longer than their glossy ad campaigns.

Airman 1st Class Daniel Brosam, Wikimedia Commons

Airman 1st Class Daniel Brosam, Wikimedia Commons

Streaming Fitness Apps

Exercise apps sell inspiration wrapped in data. Subscription models exploit guilt cycles—users start strong, then keep paying for streaks they’ve stopped maintaining. With low hosting costs, margins soar. The illusion of accountability keeps platforms profitable, even when workouts move from daily to never.

Luxury Pet Products

The American Pet Products Association projects pet industry expenditures will reach $157 billion by the end of 2025. From organic treats to plush dog beds, most premium items offer minimal functional improvement. Markups often stay high, proving that nothing sells better than love packaged as a necessity.

Wedding Markups

Once the word “wedding” enters the conversation, prices triple. Florists, venues, and photographers lean on sentiment to justify premiums. The average U.S. wedding cost hit $33,000 in 2024 (Fidelity), and projections suggest further growth, even though many packages mirror standard event services. Love funds a billion-dollar emotion industry.

Daniel Case, Wikimedia Commons

Daniel Case, Wikimedia Commons