Wealth Over Wages

Every paycheck, taxes get yanked out before you even see the money. But billionaires have found ways around that inconvenience. So what if we closed those loopholes and made everyone play by the same rules?

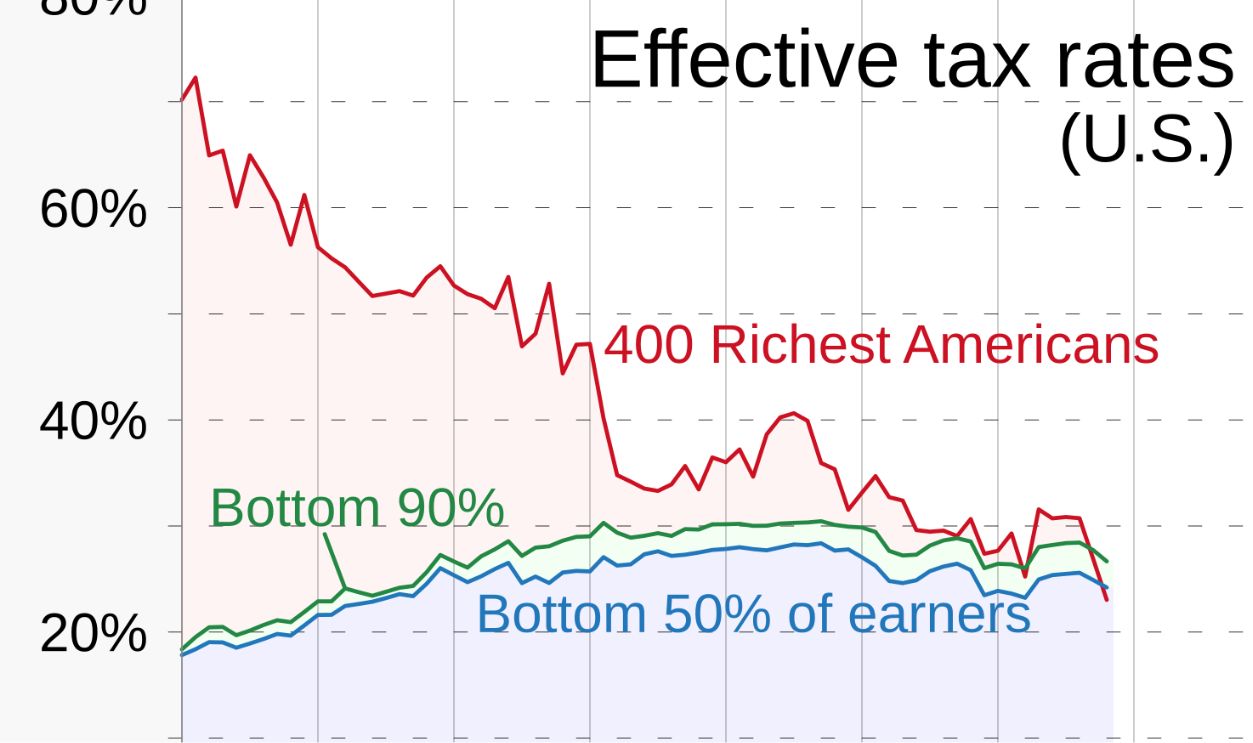

Current Tax Rate Reality Check

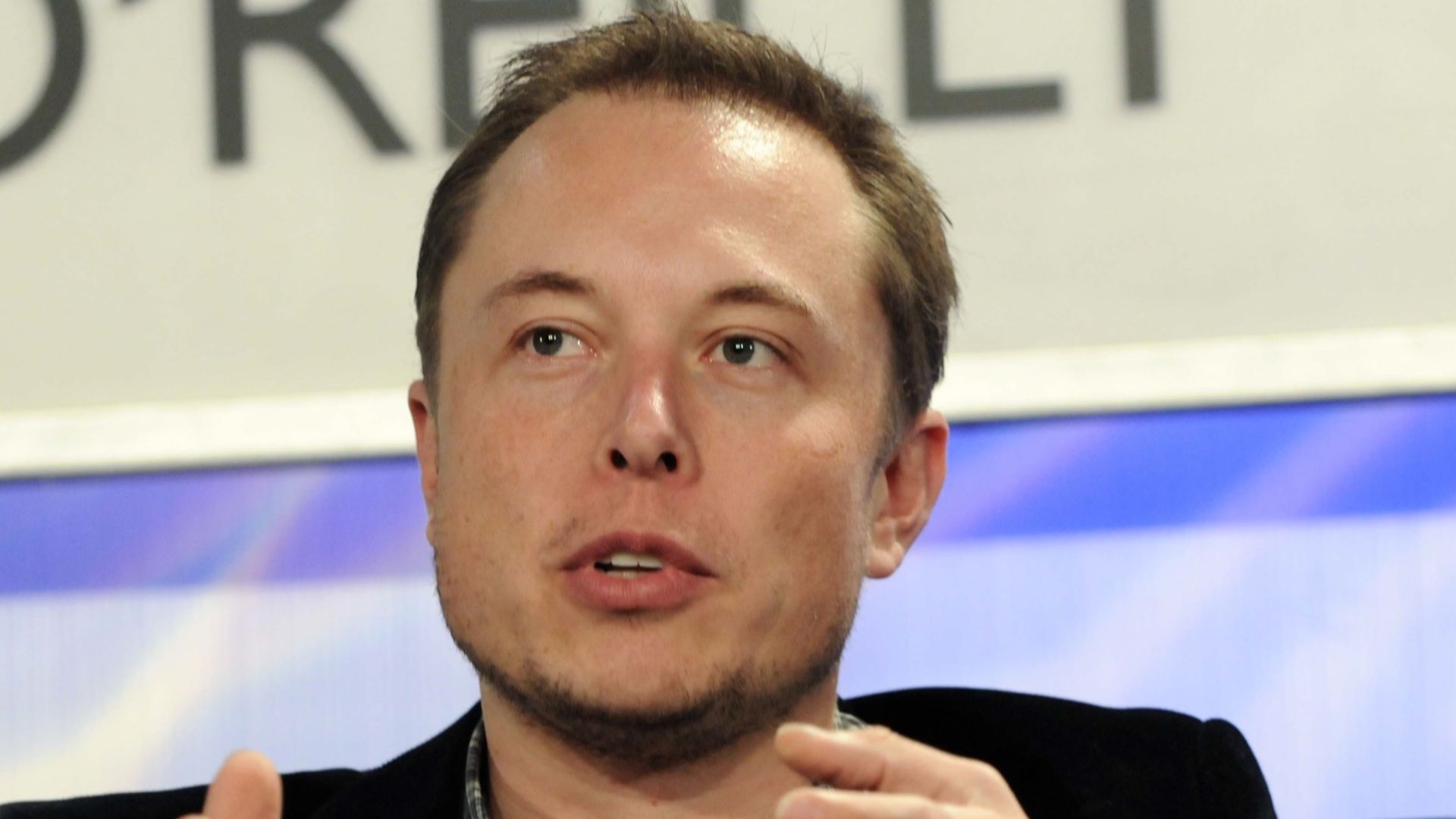

Your local teacher pays a higher tax rate than Elon Musk. It sounds absurd, but it's pretty accurate. The middle class shoulders an effective tax rate of around 25–26% when you factor in all federal taxes, while America's wealthiest tend to pay significantly less.

RCraig09, CC BY-SA 4.0, Wikimedia Commons

RCraig09, CC BY-SA 4.0, Wikimedia Commons

Middle Class Vs Billionaire Tax Burden

According to recent Treasury data, middle-income earners pay between 12–25% depending on their bracket. Meanwhile, the top 400 wealthiest Americans pay around 23% of their income using traditional calculations. However, when their massive unrealized gains are factored in, the rate drops to just 8.2%.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

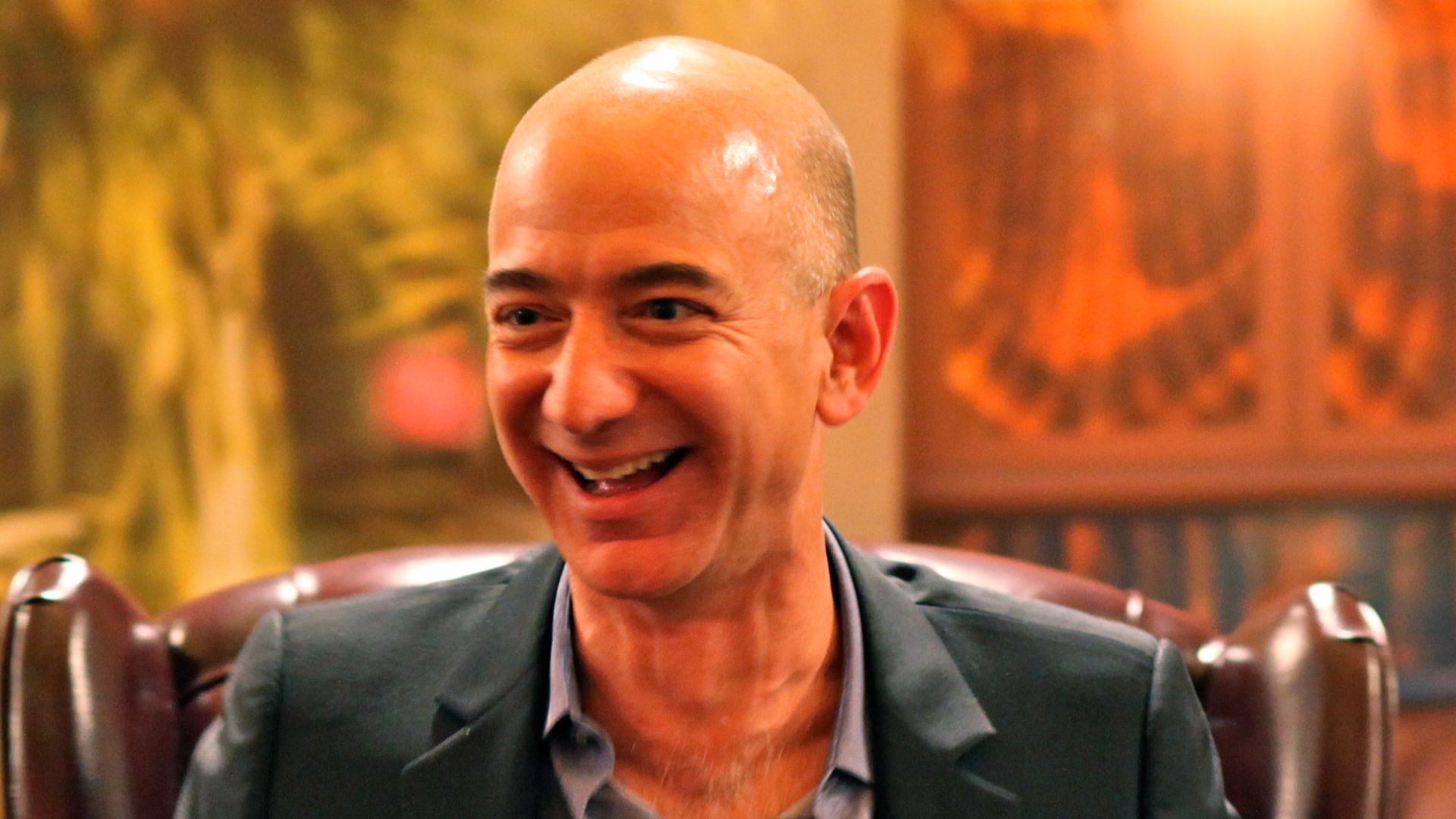

How Billionaires Legally Avoid Taxes

Jeff Bezos drew a salary of around $81,840 from Amazon in 2020, which is less than what many teachers earn. This is strategic tax planning. Since wages are taxed heavily while asset appreciation isn't taxed until sold, billionaires structure their compensation through stock options and equity.

Steve Jurvetson, Wikimedia Commons

Steve Jurvetson, Wikimedia Commons

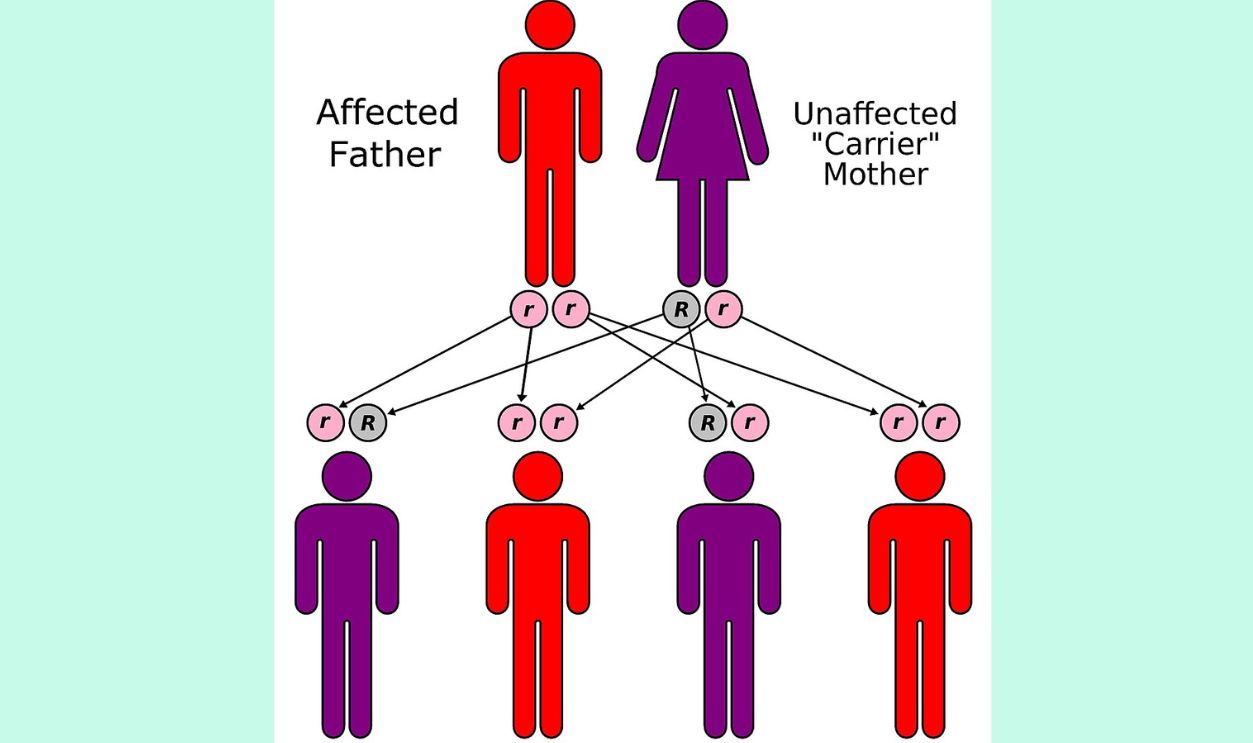

Unrealized Gains Loophole

Emmanuel Saez calculated that of the $4.25 trillion in wealth held by US billionaires, approximately $2.7 trillion exists as unrealized gains. Say you bought Apple stock for $1,000 and it's now worth $10,000, you haven't technically "made" $9,000 until you sell it.

Buy-Borrow-Die Strategy

Wealthy individuals borrow against their appreciating stock portfolios to fund lavish lifestyles without triggering taxable events. Interest rates on these loans often remain below asset appreciation rates, creating essentially free money while preserving underlying investments. The key barrier is having appreciable, high-value assets to borrow against.

Death Tax Shield

Apparently, when billionaires die, their heirs inherit assets with "stepped-up basis," meaning inherited stocks reset to current market value and erase all previous capital gains from taxation permanently. This allows families to transfer billions across generations while avoiding taxes on decades of appreciation.

Mark v1.0, CC BY-SA 4.0, Wikimedia Commons

Mark v1.0, CC BY-SA 4.0, Wikimedia Commons

Borrowed Funds

Such folks can also live indefinitely on borrowed funds. Banks eagerly lend against blue-chip stock portfolios because the collateral tends to grow at a faster rate than the loan balances. When borrowers default, banks simply seize appreciating assets worth more than the original loan amount.

ProPublica's Tax Rate Findings

In 2021, ProPublica obtained confidential IRS data revealing the "true tax rate" of America's 25 richest individuals. Apparently, these people paid just $13.6 billion in taxes between 2014–2018 on a combined wealth increase of $401 billion—an effective rate of 3.4%.

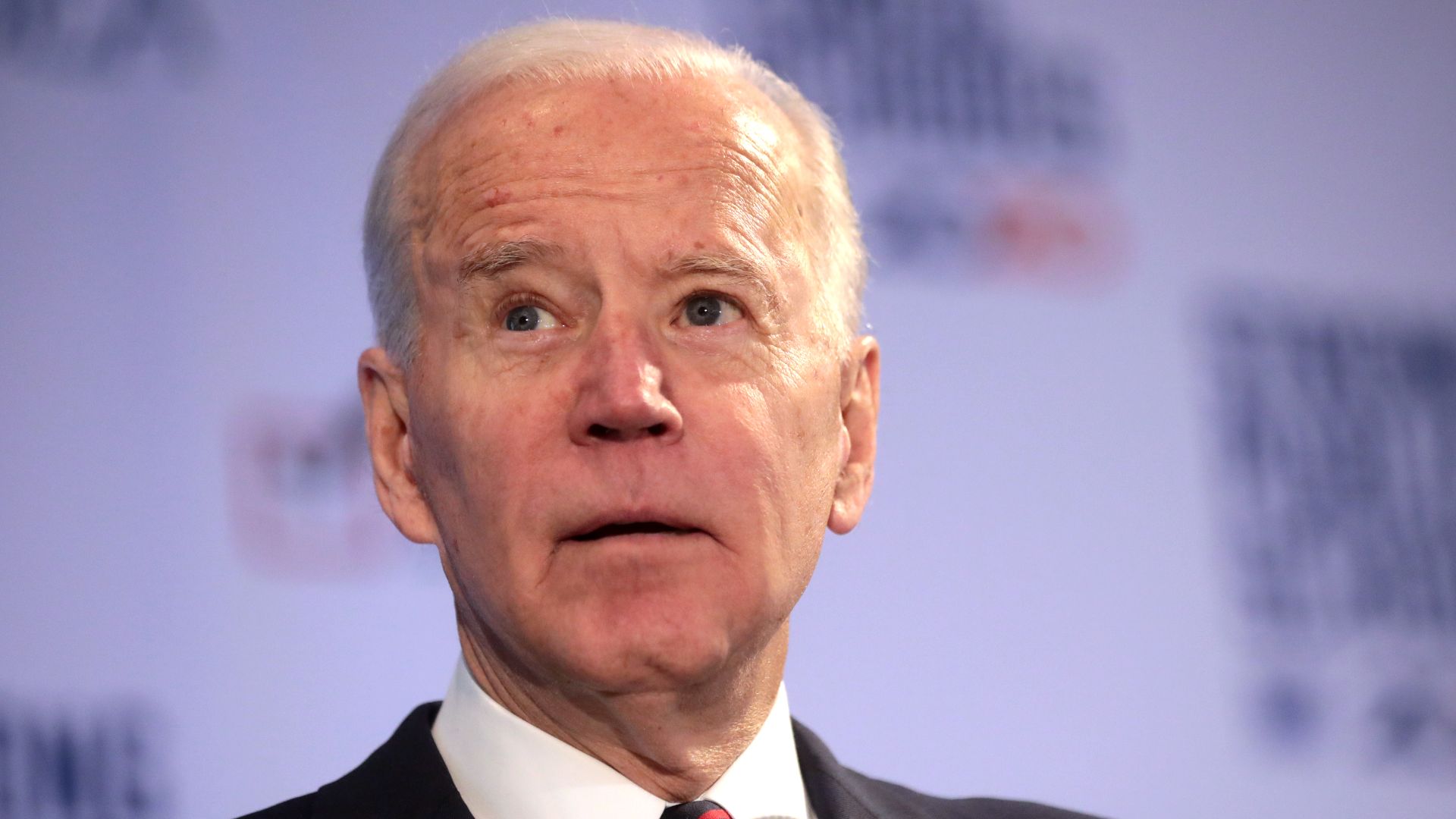

Biden's 25% Minimum Tax Proposal

At his 2024 State of the Union address, President Biden declared: "No billionaire should pay a lower tax rate than a teacher, a sanitation worker, a nurse!" His administration's solution is a 25% minimum tax on households with a net worth of $100 million.

Gage Skidmore from Surprise, AZ, United States of America, Wikimedia Commons

Gage Skidmore from Surprise, AZ, United States of America, Wikimedia Commons

$50 Billion Solution

This isn't just political rhetoric. The proposal has concrete numbers behind it. With approximately 1,000 billionaires in the United States, the administration estimates this tax would generate $500 billion over ten years, or $50 billion annually. The tax would apply to both realized and unrealized gains.

Traditional Income Vs Asset-Based Wealth

The fundamental disconnect lies in how we define "income" in the 21st-century economy. Traditional tax policy was designed when most wealth came from wages, not asset appreciation. A factory worker's income is obviously their paycheck, which is easily taxable and impossible to hide.

Daily Million-Dollar Tax Dodge

However, a billionaire's wealth primarily comes from owning appreciating assets like stocks, real estate, and business equity. While the factory worker pays taxes on every dollar earned, the billionaire watches their net worth increase by millions daily without touching any tax liability.

Why Current Tax Calculations Vary

Depending on who's doing the math, billionaires either pay their fair share or pay almost nothing, and both can be technically correct. The IRS reports that the top 400 taxpayers paid an average rate of 23.1% in 2014, but this only counts traditional income sources.

Perspective Problem

The White House calculation showing 8.2% includes unrealized capital gains as income, while ProPublica's 3.4% figure looks at wealth growth versus taxes paid. It's like measuring a skyscraper from different floors—each perspective yields dramatically different results. The methodology matters enormously.

User:Cezary Piwowarczyk, Wikimedia Commons

User:Cezary Piwowarczyk, Wikimedia Commons

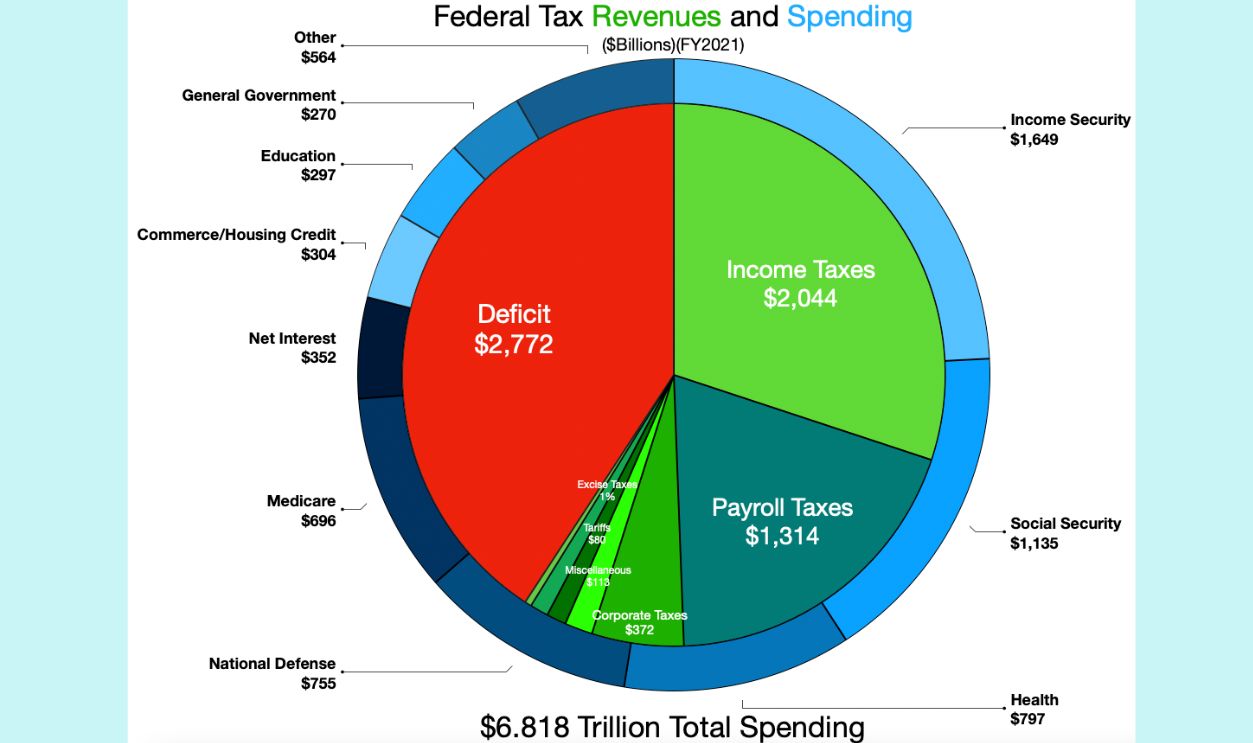

Revenue Compared To Federal Budget

Defense spending alone consumes $850 billion a year, making the $50 billion from billionaire taxes seem modest by comparison. However, transformative social programs often cost less than expected. The National Science Foundation's entire budget is just $8.8 billion, demonstrating how billionaire tax revenue could dramatically expand scientific research.

Wikideas1, CC0, Wikimedia Commons

Wikideas1, CC0, Wikimedia Commons

Universal Programs Within Reach

As per sources, Head Start serves 900,000 children with a $10 billion budget, yet 2.5 million eligible children remain unserved due to funding constraints. Billionaire tax revenue could quintuple this program's reach, providing early childhood education to every qualifying family.

Infrastructure Investment Possibilities

America's infrastructure earned a C grade from civil engineers, with $2.6 trillion needed for repairs over the next decade. While billionaire taxes may not cover everything, $50 billion annually could address critical priorities. For instance, replacing the 56,000 structurally deficient bridges would cost $164 billion.

Enforcement Challenge

Collecting taxes from people who can afford armies of accountants and lawyers presents unique difficulties that middle-class audits never encounter. Wealthy taxpayers can afford to litigate disputes for years. Sadly, working families are often compelled to accept IRS determinations to avoid incurring legal costs.

Asset Valuation Complications

How do you price Elon Musk's SpaceX shares when they don't trade publicly? Unlike your 401k with daily market values, billionaire assets often exist in private companies or complex financial instruments without clear market prices. The Mona Lisa is priceless, hence impossible to value for tax purposes.

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

Capital Flight Concerns

Norway implemented a wealth tax in the 1990s, then watched billionaires pack their bags and move to Switzerland, taking their tax base with them permanently. France tried taxing the rich and saw similar exodus patterns, ultimately abandoning their wealth tax after losing more revenue than they gained.

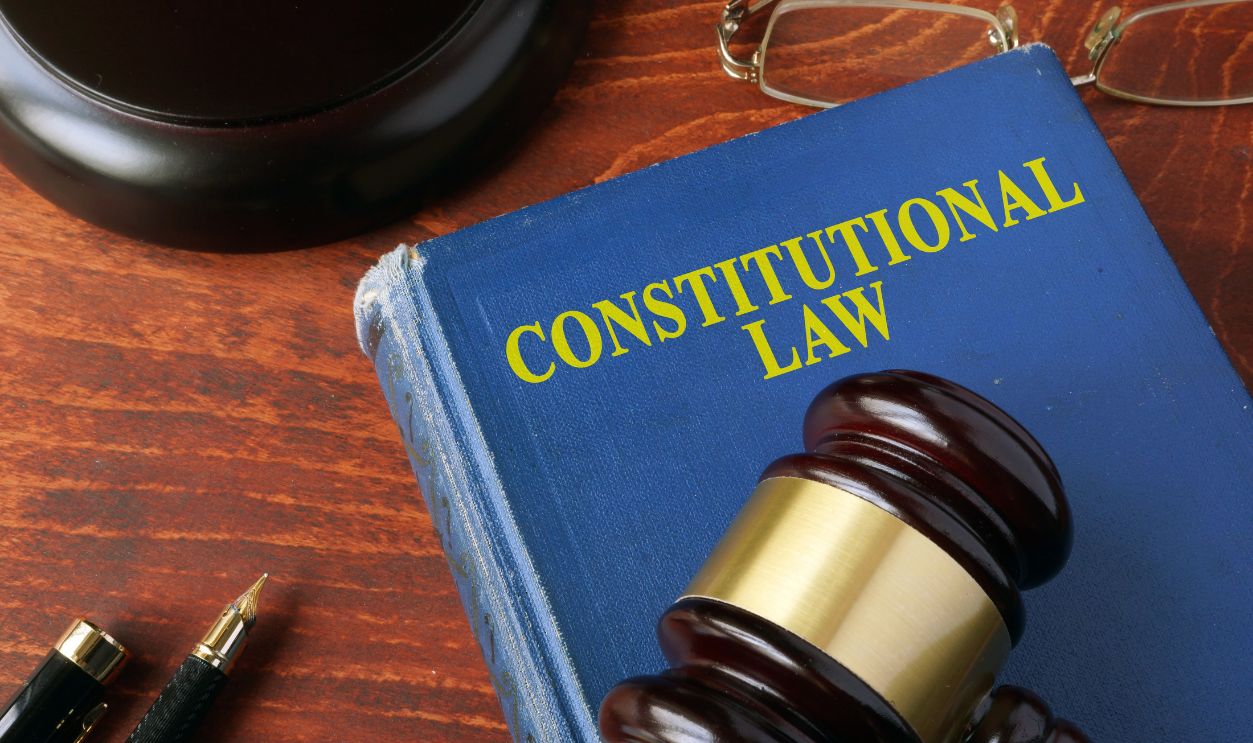

Constitutional And Legal Hurdles

The Constitution grants Congress power to levy "direct taxes" only if apportioned among states by population. This is a requirement that makes taxes legally questionable. Income taxes required the Sixteenth Amendment in 1913 to become constitutional. Wealth charges would likely face immediate Supreme Court challenges.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

State Tax Arbitrage

Billionaires can relocate to zero-tax states like Florida or Texas before realizing grand capital gains, avoiding state income taxes on billion-dollar transactions. This geographic tax planning remains unavailable to most working families tied to specific locations by jobs, schools, and family obligations, creating mobility-based tax advantages.

Johntex~commonswiki, Wikimedia Commons

Johntex~commonswiki, Wikimedia Commons

International Wealth Tax Examples

Switzerland maintains limited wealth taxes across cantons, generating modest revenue while keeping wealthy residents satisfied with the arrangement. Spain reintroduced wealth taxes in 2021 after abolishing them, though collections remain minimal compared to income taxes. Colombia implemented another tax in 2022, too recent for meaningful evaluation.

Tomchen1989, NordNordWest, TUBS, CC BY-SA 3.0, Wikimedia Commons

Tomchen1989, NordNordWest, TUBS, CC BY-SA 3.0, Wikimedia Commons

Public Support

Polling consistently shows 75% of Americans support higher taxes on the affluent, including 58% of millionaires themselves in G20 countries, according to Patriotic Millionaires surveys. Yet public opinion rarely translates directly into policy changes, especially when wealthy interests can fund lobbying campaigns and political contributions.