Keeping Fortune On A Leash

Money moves fast, and without a plan, it can vanish just as quickly. The wealthy personalities we already know stay rich by setting boundaries before trouble hits.

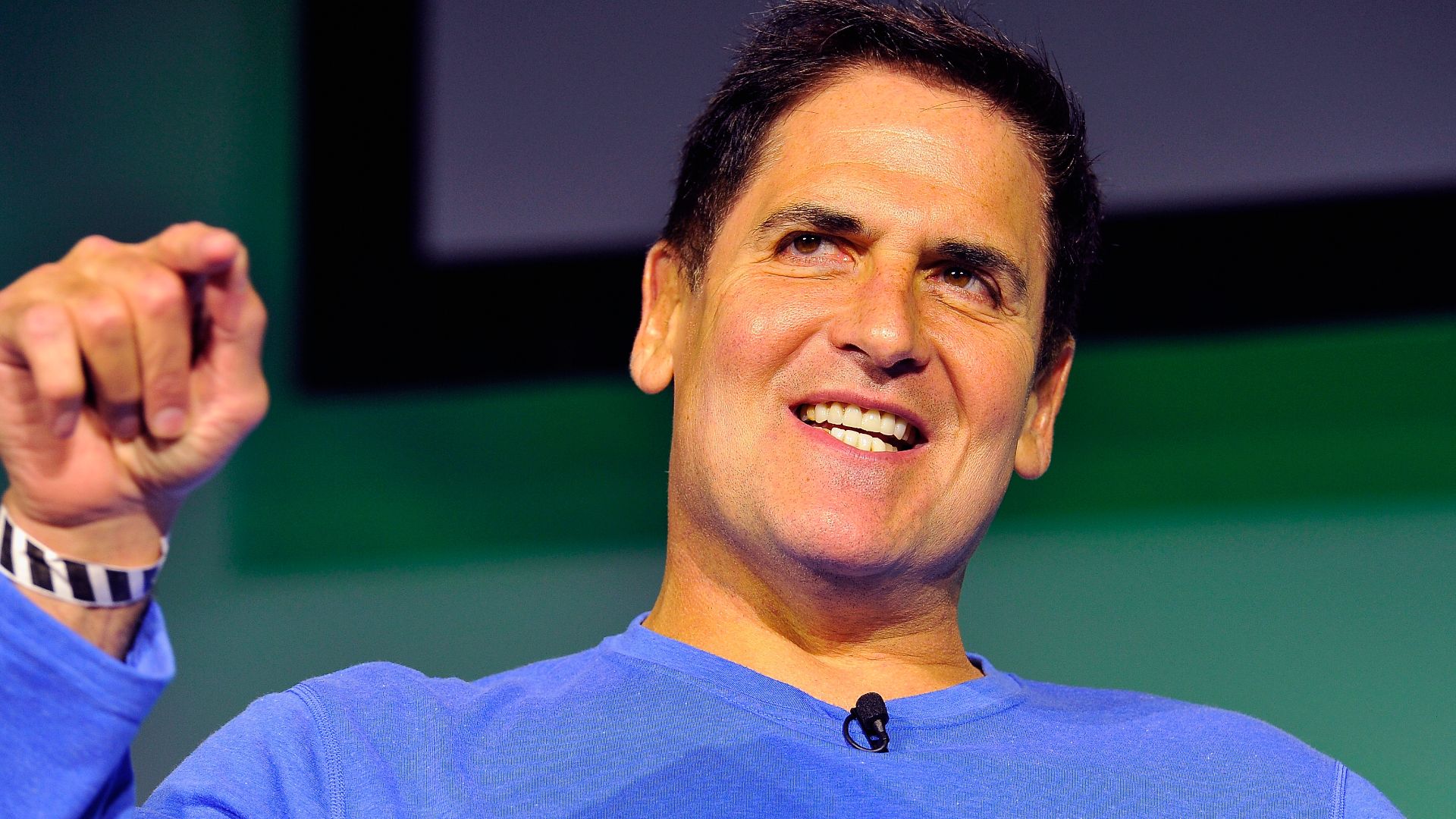

Mark Cuban Avoids Debt To Safeguard Liquidity

Cuban runs his finances like a no-interest business. Cash stays king, and every major purchase clears. The absence of loans gives him speed, freedom, and full control. His liquidity keeps him nimble when deals move faster than banks can blink.

Gage Skidmore from Peoria, AZ, United States of America, Wikimedia Commons

Gage Skidmore from Peoria, AZ, United States of America, Wikimedia Commons

Warren Buffett Holds Substantial Cash Reserves For Stability

Buffett parks billions in cash as his comfort zone. It cushions turbulence and funds opportunities others can’t afford. When markets freeze, his liquidity turns into bargaining power. His calm during chaos comes from those quiet piles of patient money.

USA International Trade Administration, Wikimedia Commons

USA International Trade Administration, Wikimedia Commons

Elon Musk Uses Legal Entities To Separate Personal And Business Assets

Every venture under Musk’s umbrella operates through its own company shell. These boundaries confine risk and protect personal holdings. Corporate layers create safety walls that withstand lawsuits and volatility. This structure turns ambition into a well-guarded network of ownership.

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

Oprah Winfrey Employs Trusts For Estate Privacy And Tax Protection

Oprah Winfrey’s estate is managed through carefully structured trusts. These trusts manage wealth transfers quietly and keep valuations private. Strategic planning inside those documents maintains order across generations. Each clause works like a lock, keeping her financial world secure and discreet.

INTX: The Internet & Television Expo, Wikimedia Commons

INTX: The Internet & Television Expo, Wikimedia Commons

Richard Branson Uses Insurance For High-Risk Ventures

Mr Branson treats risk as a cost of exploration. Virgin companies operate in high-risk sectors—aviation, travel, and space—and carry tailored insurance. Those protections keep adventure profitable. Insurance for him functions as armor, not an afterthought.

Chatham House, Wikimedia Commons

Chatham House, Wikimedia Commons

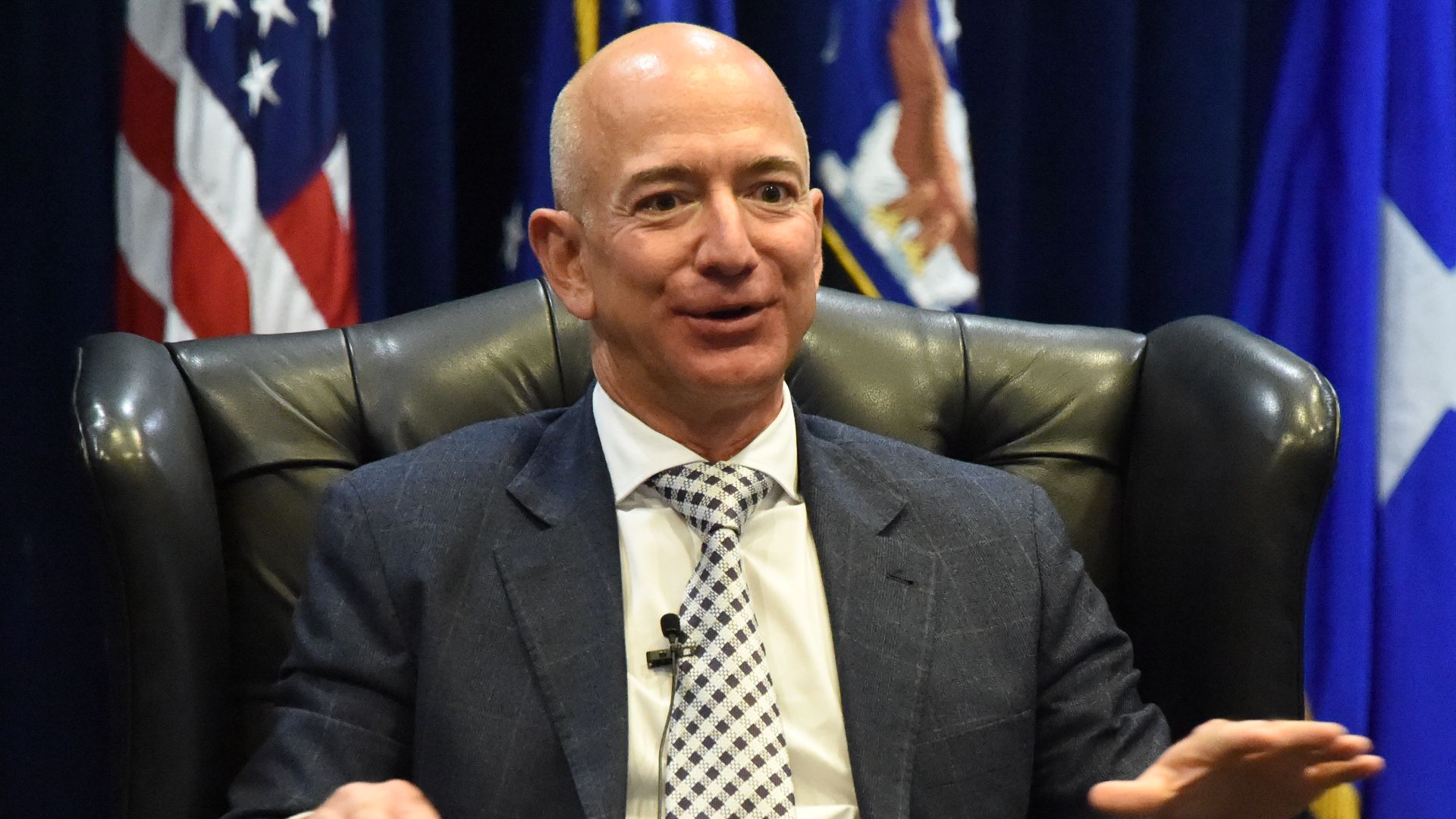

Jeff Bezos Shields Wealth Through Diversified Asset Ownership

The Amazon tycoon spreads his fortune across multiple industries. He has shares in space ventures and real estate, which balance one another because their market shocks rarely overlap. That blend of business categories ensures that one storm never swallows his entire horizon of investments.

Los Angeles Air Force Base Space and Missile System Center, Wikimedia Commons

Los Angeles Air Force Base Space and Missile System Center, Wikimedia Commons

Bill Gates Funds A Family Foundation For Tax-Efficient Wealth Management

Gates channels capital into his foundation, where charitable projects meet financial precision. Endowments grow, grants circulate, and assets stay active under expert oversight. The structure multiplies social impact while preserving control of immense wealth through organized giving.

Kuhlmann /MSC, Wikimedia Commons

Kuhlmann /MSC, Wikimedia Commons

Jay-Z Stores Wealth In Tangible Art And Collectibles

Art lines Jay-Z’s walls like a second portfolio. Paintings and rare items mature in value quietly. Tangible assets provide both privacy and growth. Culture and capital intertwine, forming wealth that doesn’t depend on trading screens.

Joella Marano, Wikimedia Commons

Joella Marano, Wikimedia Commons

Mark Cuban Keeps Large Portions In Index Funds, Not Speculative Stocks

Back to Cuban, who relies on market breadth rather than single bets. Index funds track economies over decades, and this lets time handle performance. Broad exposure evens volatility and compounds returns. His steady approach treats investing as maintenance, not entertainment.

Gage Skidmore, Wikimedia Commons

Gage Skidmore, Wikimedia Commons

Larry Ellison Invests Heavily In Long-Term Real Estate Holdings

Ellison favors property with permanence. Coastal estates, islands, and urban blocks anchor his wealth. Real assets endure through inflation, politics, tech, and sometimes trend shifts. Every purchase adds stability that digital money alone can’t promise.

Oracle PR from Redwood Shores, Calif., USA, Wikimedia Commons

Oracle PR from Redwood Shores, Calif., USA, Wikimedia Commons

Kylie Jenner Uses Trademark Protection To Preserve Brand Value

Every shade and slogan in Kylie Jenner’s lineup sits under trademark protection. That legal framework keeps imitators out and royalties in. Her paperwork transforms makeup into long-term intellectual property that grows more valuable with every new release.

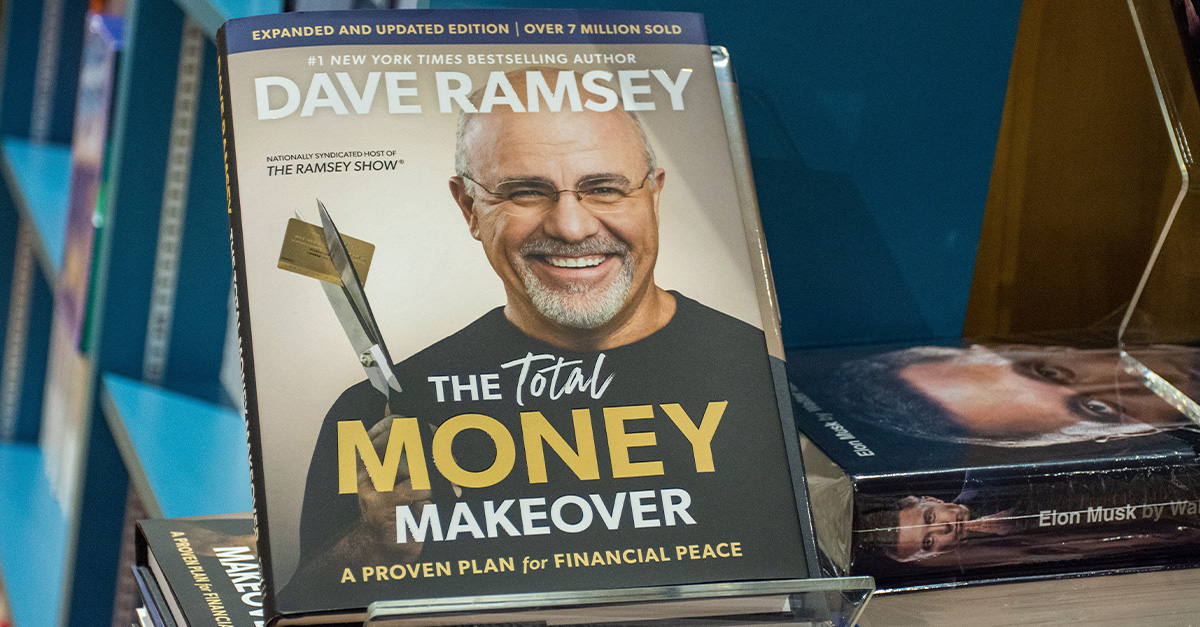

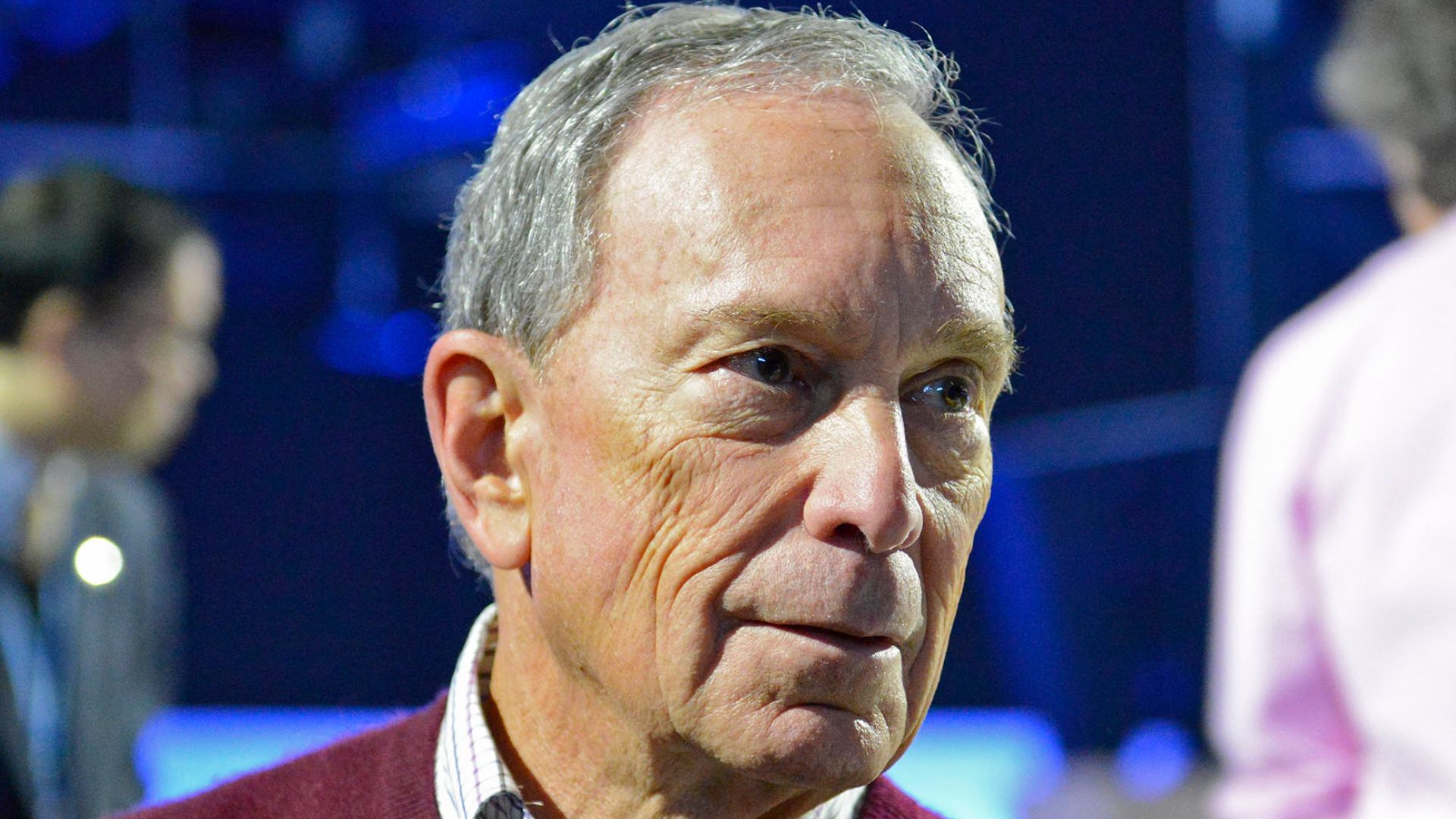

Michael Bloomberg Uses Municipal Bonds For Steady Returns

Predictable income never goes out of style for Bloomberg. Municipal bonds supply tax-advantaged interest payments while supporting public projects. They act as a calm corner in a volatile portfolio.

UNclimatechange from Bonn, Germany, Wikimedia Commons

UNclimatechange from Bonn, Germany, Wikimedia Commons

George Lucas Maintains Film Rights Under Holding Companies

The Star Wars universe remains lucrative because Lucas kept ownership tight. Separate holding companies control licensing, merchandise, and distribution. Those layers ensure profits circulate internally by turning creative genius into an empire that still prints royalties decades after premiere night.

nicolas genin from Paris, France, Wikimedia Commons

nicolas genin from Paris, France, Wikimedia Commons

Mark Zuckerberg Holds Dual-Class Shares To Retain Control

Power sits inside his share structure. Two classes of stock allow Zuckerberg to guide Meta without market interference. Investors trade, but his voting authority stays intact—keeping corporate vision consistent and long-term strategies untouched by quarterly noise.

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

Kevin O’Leary Favors Dividend-Paying Blue Chips For Stability

Quarterly payouts shape O’Leary’s comfort zone. Blue-chip firms deliver reliable dividends that compound silently. Those steady checks form a built-in paycheck from global giants, funding expansion while principal values climb through patience, not adrenaline.

Philip Romano, Wikimedia Commons

Philip Romano, Wikimedia Commons

Serena Williams Invests In Venture Capital Through Limited Partnerships

Venture deals excite her competitive edge. Williams places funds through limited partnerships that balance exposure and control. This structure lets her back promising founders while keeping legal and financial boundaries crystal clear around her personal fortune.

Doha Stadium Plus Qatar from Doha, Qatar, Wikimedia Commons

Doha Stadium Plus Qatar from Doha, Qatar, Wikimedia Commons

Elon Musk Keeps Liquidity Through Loans Backed By Stock

Borrowing against shares gives Musk spending power without dilution. Lenders secure collateral; he secures capital. The arrangement finances innovation while preserving ownership, and it turns his own equity into a reusable source of momentum.

Tesla Owners Club Belgium, Wikimedia Commons

Tesla Owners Club Belgium, Wikimedia Commons

Warren Buffett Avoids Overleveraging Berkshire Hathaway

Inside Berkshire, borrowing stays measured. Modest leverage keeps credit ratings pristine and allows swift acquisitions when markets soften. This restraint turns cash reserves into opportunity fuel whenever others run short on confidence.

USA White House, Wikimedia Commons

USA White House, Wikimedia Commons

Oprah Diversifies Media And Lifestyle Ventures To Spread Risk

Television anchors her empire, but that is only one pillar. Publishing, streaming, and wellness lines broaden reach and cushion revenue. The mix keeps momentum steady even when trends shift under entertainment’s fast-changing spotlight.

Bill Ebbesen, Wikimedia Commons

Bill Ebbesen, Wikimedia Commons

Richard Branson Separates Each Virgin Business To Contain Liability

Every Virgin venture stands on its own foundation. Everything, from airlines to space operations, operates independently, so one misstep never sinks them all. This compartmentalized design keeps Branson’s global empire balanced, with every entity shielding the next from financial turbulence.

Bill Gates Focuses On Sustainable Investments That Hold Long-Term Value

Clean energy, biotech, and agriculture form the backbone of Gates’s portfolio. Each area connects to global needs, making profits durable and relevant. His strategy fuses social progress with financial preservation—a practical blend of purpose and performance.

Mark Cuban Limits Exposure To Crypto And Volatile Markets

While innovation fascinates him, Cuban keeps risk tightly measured. A small portion of his capital touches speculative assets, and the rest stays in steady markets. That cautious ratio prevents trend-driven losses from bruising his broader net worth.

Michael Jordan Preserves Wealth Through Brand Licensing

Endorsements turned into equity is one reason Jordan’s legacy stays unstoppable. Royalties flow from apparel and media appearances linked to his likeness. Each contract extends his earning life indefinitely, and this makes his image a business that performs long after his final game.

Nicolas Richoffer, Wikimedia Commons

Nicolas Richoffer, Wikimedia Commons

George Clooney Retained Equity In Casamigos Until Exit

Patience made the difference. Clooney and his partners nurtured Casamigos slowly, prioritizing taste and identity over quick profit. Holding equity through growth years amplified his payout when the acquisition arrived, proving that time often compounds faster than hype.

Sean Reynolds from Liverpool, United Kingdom, Wikimedia Commons

Sean Reynolds from Liverpool, United Kingdom, Wikimedia Commons

Rihanna Owns Her Brand Directly Through Corporate Entities

Behind every Fenty label sits a registered company she co-owns. Ownership ensures creative authority and profit alignment remain under one roof. That model shields revenue from external interference while reinforcing Rihanna’s personal brand as a durable financial engine.

Exchange Associate, Wikimedia Commons

Exchange Associate, Wikimedia Commons