Paying For Your Kids' College Shouldn't Bankrupt You, Here's How To Teach Them Fiscal Responsibility While Still Being Helpful

You've decided you don't want to pay for your kids' college education. Or maybe you cannot afford to do so, like many families nationwide and worldwide. Revealing this to your children can be devastating to them, particularly if they were expecting that financial support. But you're not a bottomless pit of money, so if you don't want to or cannot afford to pay for your kids' college fund, they must understand why and what to do next.

Having The Conversation With Your Kids

Difficult conversations about money with your children can be challenging, but it's important not to beat around the bush. By the time they're teenagers, they should have a firm grasp of money and its workings, including knowing how to earn, save, and spend it responsibly. So, broaching the topic of college shouldn't be a huge issue.

Be Open About Your Finances With Your Kids

If you're going to be saving some money for a college fund, discuss that with your kids earlier in their teenage years. Even if you ultimately decide not to use it for that purpose, you should be open and transparent about your opening an education fund for them.

"I'm Not Going To Be Paying For Your College Tuition Because X"

You must be direct and to the point. You won't be paying for their college tuition, and that's that. Help them understand why you're not going to be footing the bill. If it's because you cannot afford it, say so! There's no shame in not being able to afford to send your kid to college. That's what student loans are for.

"I'm Never Speaking To You Again!" And They Storm Off In A Rage

Of course, this is the least desirable of all outcomes. You want your kids to be able to accept things and move past them, rather than reacting angrily and holding onto that anger in themselves—it's not good for them emotionally. Give them time to process their feelings, and try explaining yourself again.

Encourage Them To Apply For Student Loans

Even if they know you've set up a college education fund for them, encourage your kids to apply for student loans anyway. Not only will this teach them the value of loans and paying off debts, but it will give them some insight into how the process works so that if they choose to apply for higher education, they can do so more easily in the future.

"But You Said You'd Pay For It!"

Even if you've made that promise or opened up a post-secondary education savings plan, like a 529 plan, for your kids but you decide not to use it, ultimately, that's your decision. Explain why you're choosing to allow them to take out student loans instead.

Taking Ownership Of Their Education

Their education is their responsibility. If you've paid for their education once, what's to say you won't do it again if they're unserious about it and flunk out of college? Sure, you could pay for their education the first time around, and then agree not to do it again. But once they've failed their courses and crashed out, your money would be wasted. When it's their own student loan money on the line, they'll be much more careful about their grades.

It Will Ensure They're In It For Themselves

Sometimes, kids go to college because their friends are all going, or there's a heavy expectation from you (their parents) that they go to college and get a degree and set about on the treadmill of working to live and living to work. If you're paying for their college tuition, they might not even want to go to college, but are doing it to please you. By not offering to pay for their college, they're definitely in it for themselves and bettering their lives.

It Teaches Them About Bureaucracy

Perhaps less important, but your kid will learn a lesson about applying for different things when they apply for student loans and how to navigate the (sometimes) bureaucratic nightmare that is the student loan program in the United States. Teaching them how to navigate that bureaucracy is important and will save them frustration when they're with other, larger bureaucracies later in life.

It Teaches Them The Value Of Patience

Sometimes, the waiting game to see if they've been approved for student loans is a long and painful one. Having patience with the system and waiting for that all-important acceptance letter will teach them about patience—more than they hopefully already know.

Broadening Their Collegiate Horizons

By not paying for their student loans, their horizons are automatically broadened because suddenly they have to consider where they can afford to go to school, rather than where Mom and Dad can afford to send them. They may even consider a different field of study than before.

Community Colleges Become More Viable Options

If you were going to be paying for your kids' schooling, then they may have had their hearts set on university or college. But if you refuse to pay for it, your kids may expand their horizons to include community colleges or other less expensive post-secondary institutions. These can often offer very different experiences to universities, but without the extraordinary tuition costs.

They May Choose To Forego College For The Time Being

Another valuable lesson that your kids will learn from this is that there is no shame in working hard and saving up for your college education. This may give your kids pause on the whole "college right out of high school" thing. They may need to work after graduation to put themselves through college if they don't apply for (or are unsuccessful in acquiring) student loans.

It Teaches Them To Put Their Best Foot Forward

Scholarships are free money given to high-achieving students of athletic or academic prowess in order to attend specific universities or colleges. But your kids will need to make applications for these scholarships. They'll learn to put their best foot forward and advertise themselves and their academic accolades in a professional manner, probably for the first time since they first built a resume.

Student Loans Teach You About Saving

Being a broke student is sort of a rite of passage, unfortunately, for many American children. But, having to pay off student loans will teach your children about saving what they've earned. Rather than you financing your kids' education and then spending their earned money (from their (hopefully) part-time job during college) on fun nights with friends, they'll be saving every spare dollar and throwing it at their student loans.

Student Loans Will Teach Them About Paying Off Debt

The average student loan debt balance nationwide is about $40,000, across a population of about 43 million people—the number of Americans who have student loan debt. But whether their debt is $40,000 or $140,000, paying off their student loans will teach them a valuable lesson about paying off debt.

They Can Use The Snowball Method To Pay Off Debt

Many financial experts tout the debt snowball method as a way to pay off debt faster than any other repayment method, as it lists your debt from highest to lowest interest rate, then has you directing money towards the highest-interest debt first, then using the gained interest from paying that off to pay off the next largest debt. The snowballing effect eventually wipes out all debt.

Budgeting For Student Loans

If your kids have student loans, they'll need to learn to budget for them, even if they're making minimum payments. If they haven't learned to make a budget yet, then before they head off to college—when they're responsible for their own clothing, food, and even shelter for the first time—is a great place to start.

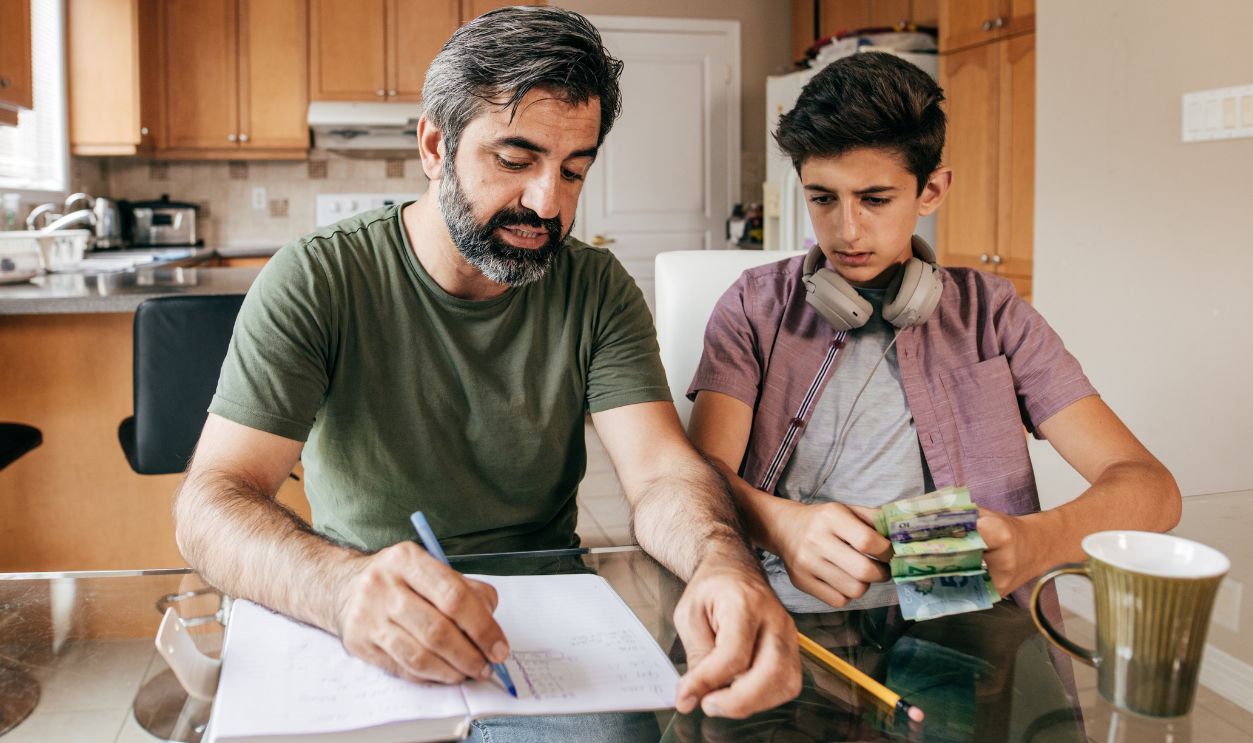

Start By Teaching Them To Build A Basic Budget

Start off by teaching your kids to build a basic budget, incorporating all of their expenses minus their income. They should have hard figures about what they'll have left over once their fixed expenses (including their minimum payment on the student loans) have all been accounted for.

Move To A Zero-Based Budget To Get Them Thinking About Their Money Intentionally

Once they're familiar with the concept of budgeting and have used a traditional budget for a few months without overspending, it may be time to consider teaching them about zero-based budgeting. This is a budgeting method where your expenses minus your income equals $0. The goal of a zero-based budget is that you give every dollar a purpose and spend intentionally.

Student Loans Should Be Attacked Vociferously Under A Zero-Based Budget

Assuming your kids don't have a car loan or credit card debt, then their student loan is often their most significant debt amount once they complete their education. Under a zero-based budget, every spare dollar, once necessities are accounted for at the end of each month, should go towards their student loans. This way, they'll pay off their student loans faster.

The Importance Of A Part-Time Job

If you don't want to pay for your kids' education, then it may be wise to extend that sentiment to the rest of their college life as well. For instance, if they start asking you to pay for their food or pay their rent—say no. Part of being a responsible college-going adult is being able to afford to pay for their lives. Even if that means they live on "rice and beans", getting a part-time job in college is a great way to pay down their student loans faster.

Breaking The Loans Down Into Manageable Bites

Sure, a $100,000 student loan can seem like a huge mountain to climb, particularly if they're receiving no financial support from you. But if they break down that loan into more manageable bites by doing up their monthly budget, they'll be able to pay it off in no time.

Ways Your Kids Can Save Money On Their Student Loans

However, it's not all about breaking down the loan into more manageable or just budgeting for it. There are excellent options that allow your kids to save money on their student loans. Let's go over some options you could share with them.

Pay More Than Monthly Minimums

Going back to budgeting, if they have any extra money, tell them they should throw it at their student loans. They're required to make minimum payments every month, but if they've got any spare cash or get a raise at work, they should use that extra money to pay off their debts faster, even if it's just a few extra dollars.

Don't Wait To Start Paying Them Off

Most commonly, recent graduates are given a six-month grace period before student loan payments are taken out of their bank accounts automatically, or payments are due to begin. Unfortunately, the interest that's accruing on those loans doesn't wait for six months; it starts immediately (at a rate of between 6.53% and 9.08%). Don't let your kids wait to pay off their student loans just because they can.

Look Into Loan Forgiveness Programs

Specific professions may offer loan forgiveness programs, or the federal government could offer loan forgiveness to your kid after they've made 120 consecutive payments monthly, while working full-time. There are over 140 student loan forgiveness programs through the federal government, have your child look into these options if they're struggling to make payments.

Use Tax Refunds

When your kids start filing taxes, they could receive a nice tax refund from the government. While they may be tempted to blow this on a new pair of shoes or a weekend away with their friends, if they put it towards their student loans, they'll be able to pay them off faster.

The Student Loan Interest Deduction

Another tax-related option to decrease their student loan payment overall is to apply for the Student Loan Interest Deduction, allowing them to deduct $2,500, or the amount of interest they actually paid during the year (whichever is lowest), up to a certain limit for their filing status. This deduction could then be put toward the principal of the loan.

Use A Gift From Relatives To Pay Them Off Faster

If they receive some money at Christmastime or birthdays from an aunt or grandparent, they could allocate that money to their student loan payments. Or, if they unexpectedly receive an inheritance from a deceased family member, that lump sum could be applied to their student loans.

Enroll In Autopay

If your kids are responsible for paying their student loans without using autopay, then it's possible they could accidentally miss a payment. Life gets busy and people forget about things when life gets hectic—by enrolling in auto-pay, they're guaranteed to make the payment on time, all the time.

Split The Bill In Half, Pay Bi-Weekly

Most jobs will pay you every two weeks. In order to reduce the *wince* they'll do at the end of the month when that big payment leaves their bank account, they can apply to change the payment schedule to a bi-weekly payment, lessening the hit their bank account takes at the end of the month, when other bills are due.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Pay The Interest While They're In School

They can make interest-only payments while they're in school because student loan interest doesn't capitalize when repayment begins, meaning it's added to their overall amount. If they begin making interest-only payments on the loans, their overall amount owing when repayment begins will be lower.

Refinancing Your Loans: A Good Option If You Meet Certain Conditions

Refinancing student loans is a great option if your kids have good credit and a well-paying steady job. Refinancing replaces multiple loans, either at the federal and state level (or both) with a single loan amount from a private lender, ideally with a lower interest rate than what they're currently paying.

More On Refinancing Student Loans

Ideally, they'll want to choose a new loan term that's less than what's left on their current loans. For example, if you refinanced a $50,000 student loan on a 10-year term with an 8.5% interest rate to a 7-year term with a 6% interest rate, you could save more than $10,000 but only increase your payment amount by $110/month.

See If Their Employer Offers Student Loan Repayment Program

Once they're gainfully employed, your kids should see if their employer offers any sort of student loan repayment program. This is a small amount of money that employers put toward your student loans up to a maximum amount monthly, for a number of years, or on a lifetime term. It's usually somewhere around $100/month, but that's $1,200/year, which is a huge chunk of change in the long run.

Your Kids Will Thank You Eventually

Like every other difficult lesson they had to learn growing up, your kids will eventually thank you for not paying for their college for them. It teaches them life-long financial lessons and principles that they can apply in many other areas of their life.

Finally, Student Loan Repayment Will Give Them A Sense Of Accomplishment

You remember that feeling when you paid off your student loans? Your kids will get the same sense of accomplishment when they pay off theirs! It's a fantastic feeling of freedom and finally being able to put their money into something else. No matter how long it takes, the sense of accomplishment is unparalleled.

You May Also Like:

Generational Wealth Doesn't Last Longer Than Three Generations, Here's Why & How To Change That