What happens to debts posthumously

Many people assume death marks a clean financial slate, yet the reality is far more complicated. Some debts quietly follow estates through probate to impact what families inherit and what creditors can still claim.

Why Many People Believe Debt Disappears

Many Americans assume debt vanishes when someone passes away, largely because bills stop arriving and collectors can’t call relatives immediately. Movies and anecdotes reinforce this idea, yet the law treats debt as a financial obligation tied to assets, not something erased automatically.

What Actually Happens To Debt

After a person passes on, their unpaid debts are reviewed as part of settling their affairs. Creditors may file claims, but repayment usually comes from the holdings. The process follows state law and determines whether debts are paid, reduced, or left unpaid due to available assets.

Paying Outstanding Debts

The estate includes everything a person owned by the time their life ended, such as money, property, and investments. An executor uses these assets to pay valid debts before distributing the inheritance. If funds are lacking, some creditors may receive only partial payment depending on the legal priority rules applied.

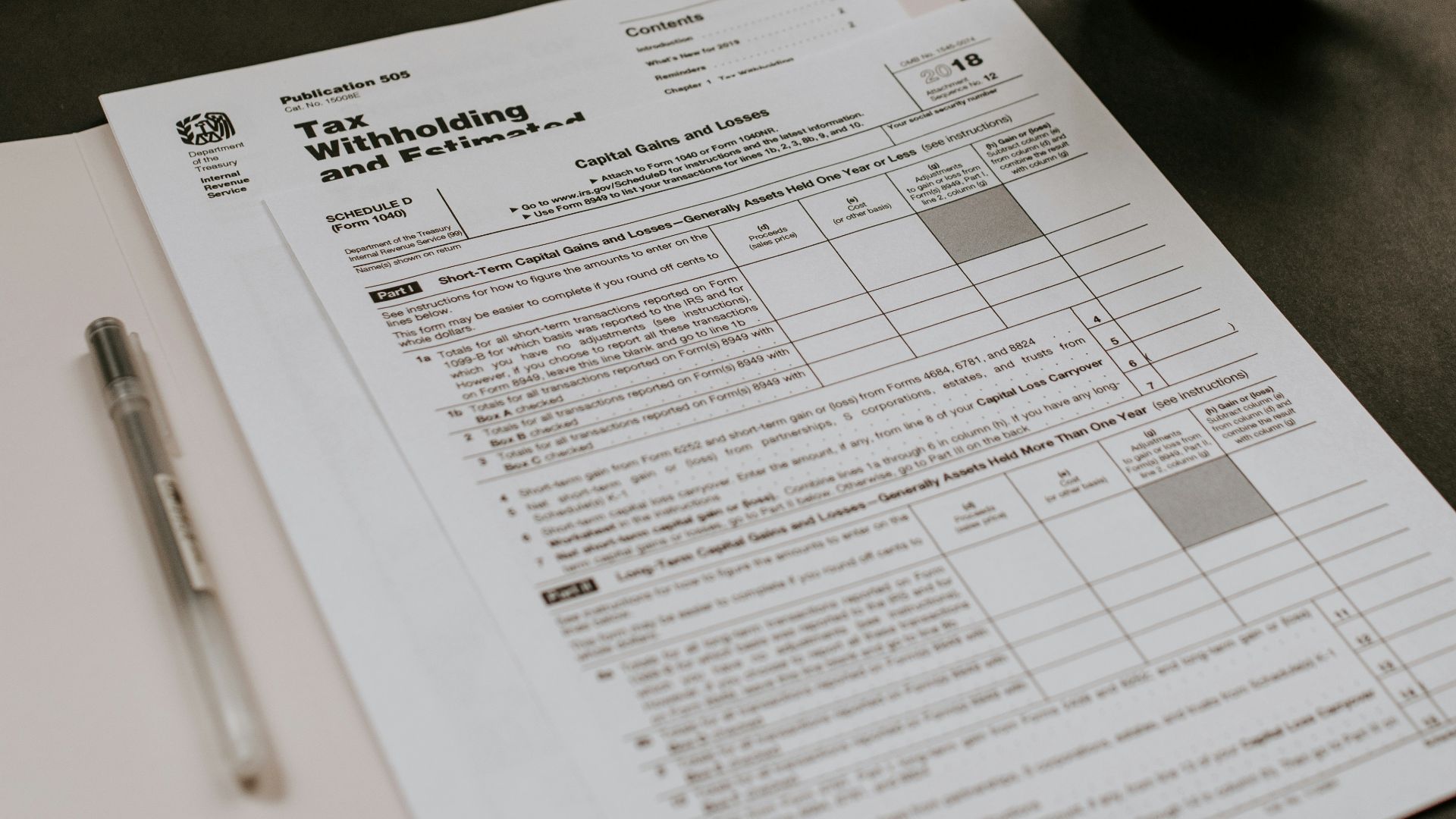

How Probate Determines Which Debts Get Paid First

Probate establishes an order for paying debts to ensure certain obligations take priority. Taxes and secured loans are often paid before credit cards. This structure protects fairness while preventing surviving family members from distributing assets before legitimate claims are resolved.

Not All Debts Are Automatically Forgiven

Some debts survive because lenders retain legal rights. Loans tied to property or backed by contracts do not disappear automatically. Understanding which obligations persist helps families avoid confusion and unnecessary financial stress during an already difficult time.

The Difference Between Secured And Unsecured Debt

Debts generally fall into two categories based on whether collateral is involved. Secured debt is tied to property, such as a home or vehicle, while unsecured debt relies solely on a borrower’s promise to repay. This distinction strongly affects what happens legally.

Secured Debts Usually Survive

Secured debts often remain because lenders can claim the underlying asset if payments stop. A person’s demise does not cancel the agreement attached to collateral. If the heirs want to keep the property, they typically must continue payments or satisfy the remaining balance owed.

How Unsecured Debts Are Handled

Personal loans, credit cards, and other unsecured debts are usually paid from assets during probate. If funds are limited, these creditors may receive reduced payments or none at all. Heirs generally are not responsible unless they share legal liability for the debt.

Mortgage Debt And What Happens To The Home

When a homeowner passes away, the mortgage does not disappear. Heirs must decide whether to continue payments, sell the property, or allow foreclosure. Federal law allows heirs to assume a mortgage without refinancing, which provides that payments remain current under the loan terms.

Car Loans And Other Auto-Related Debt

Auto loans function similarly to mortgages because vehicles serve as collateral. If payments stop, lenders may repossess the car. Heirs who want to keep the vehicle usually must continue paying the loan or pay it off, depending on lender policies and estate arrangements.

Home Equity Loans And Lines Of Credit

Loans related to home equity and HELOCs are secured by the property itself, which means lenders retain rights after death. These debts must be paid by those keeping the home. Failure to resolve them can lead to foreclosure, even if the primary mortgage is current.

Credit Card Debt After Someone’s Life Ends

After someone’s passing, credit card balances do not transfer automatically to family members, but they are still owed by the estate. Creditors may file claims during probate to recover what they are owed. If there are no funds, the remaining balances are typically written off by issuers.

Medical Bills And End-Of-Life Healthcare Costs

As one of the largest obligations after someone’s life ends, hospitals and providers may submit medical debt claims for unpaid bills. While family members usually are not personally responsible, these costs are typically paid before many other unsecured debts.

Personal Loans That Remain

When a borrower passes away, personal loans do not disappear. Lenders can file claims to recover remaining balances. If sufficient assets exist, repayment may occur in full or in part. Without assets, lenders usually absorb the loss without involving heirs.

Private Student Loans And Cosigner Obligations

There’s a difference between private student loans and federal ones because forgiveness is not guaranteed. Many lenders require repayment and cosigners remain fully responsible. Loan contracts determine outcomes. As a result, families should review terms carefully.

Federal Student Loans And Discharge Rules

However, federal student loans are generally discharged when a borrower passes away, meaning the balance is forgiven after proper documentation is submitted. Families usually must provide a death certificate to the loan servicer to prevent further collection.

Tax Debts That Don’t Go Away When You Die

Unpaid federal and state taxes must be settled before assets are distributed. The IRS and state agencies typically receive high priority during probate. Interest and penalties may continue accruing until payment, which makes unresolved tax obligations particularly important to address early.

When A Spouse May Be Responsible For Outstanding Debt

Surviving spouses usually are not liable for debts held solely in the deceased’s name. However, responsibility may arise if accounts were jointly held or if state laws apply. Understanding marital debt rules helps spouses avoid unexpected financial exposure.

Community Property States Affect Debt Liability

In community property states, many debts incurred during marriage may be considered jointly owned. This can make a surviving spouse responsible for repayment, even if only one partner signed. These rules vary by state and significantly affect how debt is handled posthumously.

What Happens When The Estate Can’t Cover All Debts

If every creditor can’t be fully paid, state law determines which claims are paid first. Lower-priority debts may go unpaid entirely, without transferring responsibility to heirs or family members in most situations, legally.

How Insolvent Estates Are Handled

When liabilities exceed assets, the executor follows strict probate rules. Assets are distributed according to priority schedules, and remaining debts are discharged once funds run out. Creditors can’t pursue heirs unless legal exceptions apply.

Common Mistakes Families Make When Dealing With Debt

Families sometimes make costly mistakes by paying debts too quickly or using personal funds unnecessarily. Others ignore probate deadlines or distribute assets prematurely. These errors can reduce inheritances and create avoidable stress.

Planning Can Minimize Debt Issues

Thoughtful estate planning can reduce confusion and financial strain. Wills and beneficiary designations help control how assets are used to settle debts. Planning ahead also allows individuals to address liabilities proactively, potentially preserving more value for surviving family members.

Knowing Your State’s Laws Makes A Difference

Debt responsibility when someone’s life ends varies widely by state. Community property and consumer protection laws shape outcomes for families. Understanding local rules helps people respond correctly, avoid unnecessary payments, and make informed decisions during estate administration and financial resolution processes.