Beyond Penny Pinching

Most people think rich folks just got lucky. Wrong. Sethi lost half his money on his first investment, then figured out the actual rules wealthy people follow. Turns out, it's about value, not cost.

Ramit's Journey

Born to Indian immigrants in California, Ramit Sethi couldn't afford college. He applied to 60+ scholarships, earned a full Stanford ride, then lost half his first check in stocks. That failure sparked his mission to master money psychology, earning degrees in psychology and sociology.

Jeremy Vohwinkle, Wikimedia Commons

Jeremy Vohwinkle, Wikimedia Commons

Self-Made Success

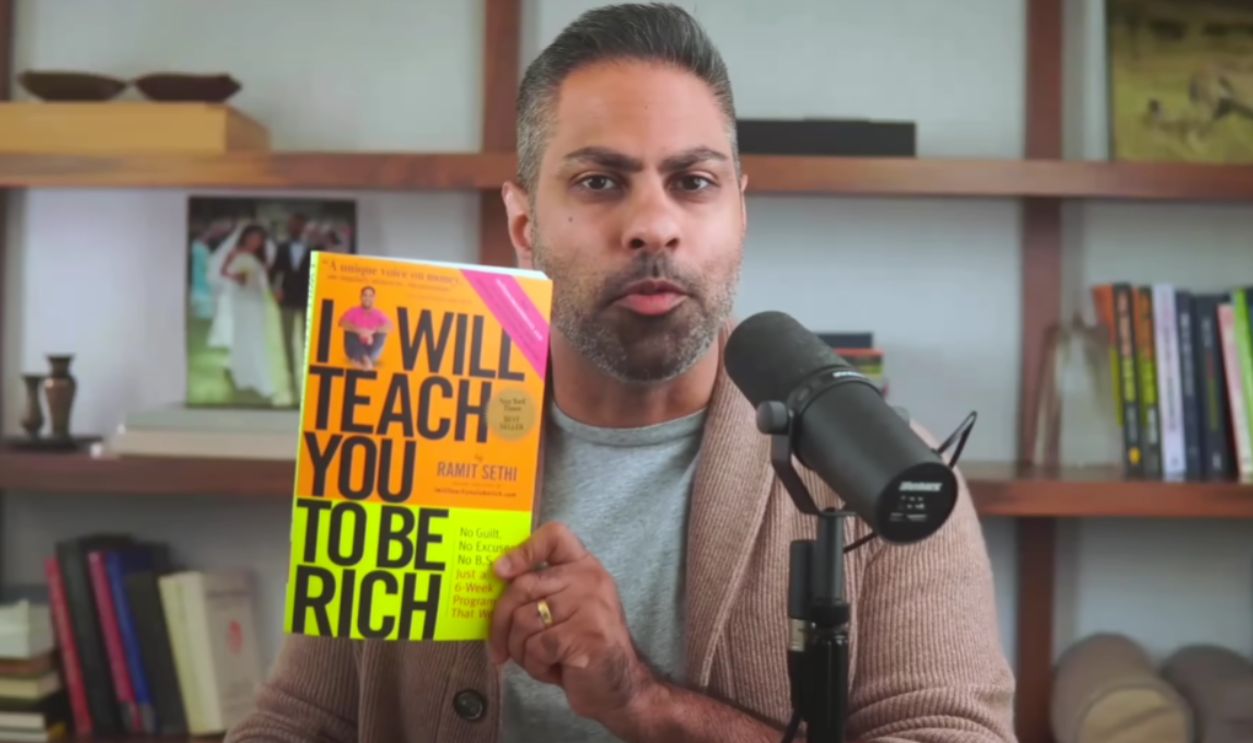

Sethi launched I Will Teach You to Be Rich in 2004, turning it into a million-copy bestseller by 2009. With a $25 million net worth, he now hosts Netflix's How to Get Rich and educates 42,000+ students. He still drives a 17-year-old Honda.

I Will Teach You To Be Rich in 10 Minutes by I Will Teach You To Be Rich

I Will Teach You To Be Rich in 10 Minutes by I Will Teach You To Be Rich

Value Thinking

Wealthy people calculate return on investment, not just price. Sethi pays for trainers instead of free YouTube videos because professional guidance saves time and delivers results. A $2,000 skill investment might generate $20,000 returns. Research shows value-focused thinkers build wealth 3–5 times faster.

Deep Knowledge

"You can't manage what you don't understand," Sethi insists. The wealthy answer seven key questions: income, debt, investment percentage, savings, spending patterns, opportunities for reduction, and goals. They know their net worth without checking phones. This financial literacy makes people 40% more likely to achieve wealth goals.

Financial Transparency

The wealthy track every dollar over 30–60 days using apps and spreadsheets, conducting monthly reviews similar to those CEOs examine when reviewing earnings. Sethi recommends real-time cash flow statements showing entire financial histories in one click. This transparency eliminates surprises and anxiety.

Cost Versus

Poor people ask, "What does this cost?" while rich people ask, "What value does this create?" Sethi explains that poor folks spend time to save money, and rich people spend money to save time. Time is finite; money regenerates.

Time Priority

Remember Warren Buffett? He considers time the ultimate non-renewable resource. The 2016 "time millionaire" movement measures wealth in discretionary hours, not dollars. Psychologist Angus Campbell's 1981 study found that life satisfaction depends most on controlling your own time. Wealthy people negotiate flexibility.

Future Vision

"Rich people plan for the future and look forward to it," Sethi observes. Research shows investors with written goals are 42% more effective, developing resilient strategies and monitoring progress. The wealthy don't dream vaguely—they calculate exact needs for college in 2032 or retirement in 2045.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Goal Specificity

Vague aspirations like "be rich" fail because brains need concrete targets. Wealthy people specify “$2.5 million by age 55 for $68,750 annual withdrawals”. This activates the reticular activating system, making you notice opportunities. People writing specific financial targets with deadlines are more likely to achieve them.

System Building

Sethi spends under one hour monthly on finances through automation. The wealthy build systems where 85% goes to checking, 10% to retirement, and 5% to savings automatically. Bills, mortgages, and investments happen without manual intervention. Behavioral economists call this “choice architecture”.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

80/20 Focus

The Pareto Principle states 80% of results come from 20% of efforts. Sethi applies this ruthlessly. Stop obsessing over $3 latte decisions and focus on $30,000 questions like salary negotiations or housing costs. These decisions impact wealth by tens of thousands annually.

Multiple Streams

IRS data reveals the average millionaire has seven income sources. Wealthy people don't rely on a single paycheck. They diversify through side businesses, publishing rights, investments, real estate, and merchandise. Financial stability comes from spreading bets across life, not just stock markets.

Strategic Investing

Wealthy individuals invest their money through diversified portfolios of stocks and real estate, capitalizing on the power of compound interest. Einstein called compounding “the eighth wonder of the world”. Warren Buffett echoes this: “Someone sits in shade today because someone planted a tree long ago”.

Compound Power

Every $100,000 invested generates $2,750 annually at conservative 2.75% withdrawal rates. This perspective makes large sums look smaller when converted to sustainable income, making wealthy folks think twice before touching principal. They understand money makes more money exponentially over time.

Patience Pays

Such individuals don't chase overnight wins; instead, they play the long game. A Rich Habits study shows Saver-Investors took 32 years to accumulate wealth, Big Company Climbers 22 years, Virtuosos 21 years, and Entrepreneurs 12 years. Patience allows compounding to do heavy lifting.

Calculated Risks

About 63% of millionaires in wealth studies took calculated risks while building fortunes. They don't gamble recklessly but assess potential upsides against downsides, moving forward when odds favor success. This might mean starting businesses, switching careers, or making unconventional investments. The keyword is “calculated”.

Meaningful Spending

“Unlimited spending on health, books, and friends' fundraisers—things important to me”. The wealthy spend extravagantly on what brings joy while cutting on meaningless expenses. They don't deprive themselves, but rather align their spending with their values. One person's "must-have" is another's waste.

Quality Investment

Wealthy people buy high-quality items that last for decades rather than cheap replacements every few years. Sethi doesn't mind paying more for clothes, phones, and cars that provide enjoyment and longevity. He'd rather repair good shoes than buy new ones.

Experience Priority

Unlike goods that depreciate, experiences like travel, fine dining, cultural events, and adventures create cherished memories, enriching life meaningfully. It is often said that experiences provide more lasting happiness. Luxury accommodations, private tours, concerts, and safaris become life highlights.

Wealth Invisibility

Morgan Housel's Psychology of Money says that wealth is what you don't see. Expensive cars and designer watches represent money already spent. Real wealth sits invisibly in investments, savings, and assets, quietly growing. The richest people don't look rich but live below their means, letting time work.

Education Investment

Talk about Sethi's personal money rule of "no limit" on education and health spending. The wealthy view education as an asset appreciating over time. A $5,000 data visualization course puts together a sellable skill generating consulting income indefinitely. Extra training sessions energize and motivate.

Relationship Building

Over 80% of millionaires in wealth studies hired teams of smart, dedicated individuals—attorneys, CPAs, marketing professionals, and financial advisors—to achieve their visions. They understand no human can do everything; outsourcing and finding good people are critical. The person you marry is among your biggest financial decisions.

Mentorship Matters

About 73% of self-made millionaires become passionate mentors, wanting to pay forward the support they received. They're inspired by champions who guided their wealth-building and career journeys. Crafting communities of positive, goal-oriented people was central to their success.

Modest Living

Accoridng to the Rich Habits study, despite wealth, 64% of millionaires describe their homes as “modest”. All owned homes, with 56% staying 20+ years. This frugal mindset prevents lifestyle creep, the tendency to increase spending as income rises. Living below means reduces stress.