My ex added me on his health insurance. He just called me and demanded that I pay half the premium even though we broke up. Do I have to?

My ex added me on his health insurance. He just called me and demanded that I pay half the premium even though we broke up. Do I have to?

When everything was rainbows and roses, your partner one day put you under their health insurance. It felt thoughtful—until “forever” turned into “we’re done.” Now they want half the premium back. And that’s where emotions meet fine print.

Before you reach for your wallet, here’s what you should really know before paying a dime.

Coverage After Love Ends

Being on your ex’s employer-sponsored plan doesn’t mean you’re legally tied to its costs forever. Once the relationship ends, eligibility usually does too. An ex-partner isn’t automatically obligated to pay premiums unless there’s a signed contract or court order. That means the “we used to share everything” argument won’t hold in court.

So, check the plan’s fine print or call HR. If the plan defines coverage for a “current spouse” or “domestic partner,” your status might have changed the moment you split. Staying listed could even risk HR calling it “fraudulent enrollment,” which no one wants on record.

NHLK, Pixabay

NHLK, Pixabay

The Legal Side—And A Few Options

In divorce cases, health insurance coverage for ex-spouses often ends once the decree is final. Most plans end coverage immediately unless a judge explicitly orders it continued. If you still need coverage, federal law has your back through COBRA, which lets you stay on the same plan for up to 36 months, though you’ll pay the entire premium plus a 2 percent fee.

Vitaly Gariev,Pexels

Vitaly Gariev,Pexels

That sounds steep, but it’s often cheaper than losing coverage entirely. Still, if your ex is keeping you on their plan and demanding half the payment, you’re under no legal duty unless you signed an agreement. Paying voluntarily doesn’t make it mandatory later.

What To Do Right Now

Before emotions (or texts) start flying:

Review the Summary Plan Description (SPD) because it spells out who qualifies as a dependent and what happens after a breakup.

Confirm you never signed a written cost-sharing deal. Verbal promises rarely count.

Ask the HR department or insurer whether they’ve been notified of your changed relationship status.

Consider independent coverage or COBRA if your eligibility ended.

Each step helps you replace awkward conversations with clear answers—and a little peace of mind.

Bottom Line

Unless a written agreement or court ruling says otherwise, you’re likely not legally obligated to pay half of an ex’s health-insurance premium. The coverage may have felt like love at first sight, but once the relationship ends, so does the shared financial duty. Stay smart, stay covered, and let the paperwork—not the past—decide who pays what.

MART PRODUCTION,Pexels

MART PRODUCTION,Pexels

READ MORE

Discovering your father took out a second mortgage for your education brings mixed emotions. It's time to explore the financial reality, emotional impact, and constructive steps forward when faced with this unexpected revelation about parental sacrifice.

That heart-sinking moment when you check your credit card statement and realize your roommate's "emergency" spending has spiraled into thousands of dollars of debt. It's a betrayal that leaves you financially vulnerable and emotionally paralyzed. Here's how to regain control.

You helped your friend get a job with your organization, but now she's showing up late every day and driving everyone nuts. We look at how to handle the situation.

In 2016 a student sued her law school, claiming the university misled its students about employment outcomes after graduation.

When everything was rainbows and roses, your partner one day put you under their health insurance. It felt thoughtful—until “forever” turned into “we’re done.” Now they want half the premium back. And that’s where emotions meet fine print.

Before you reach for your wallet, here’s what you should really know before paying a dime.

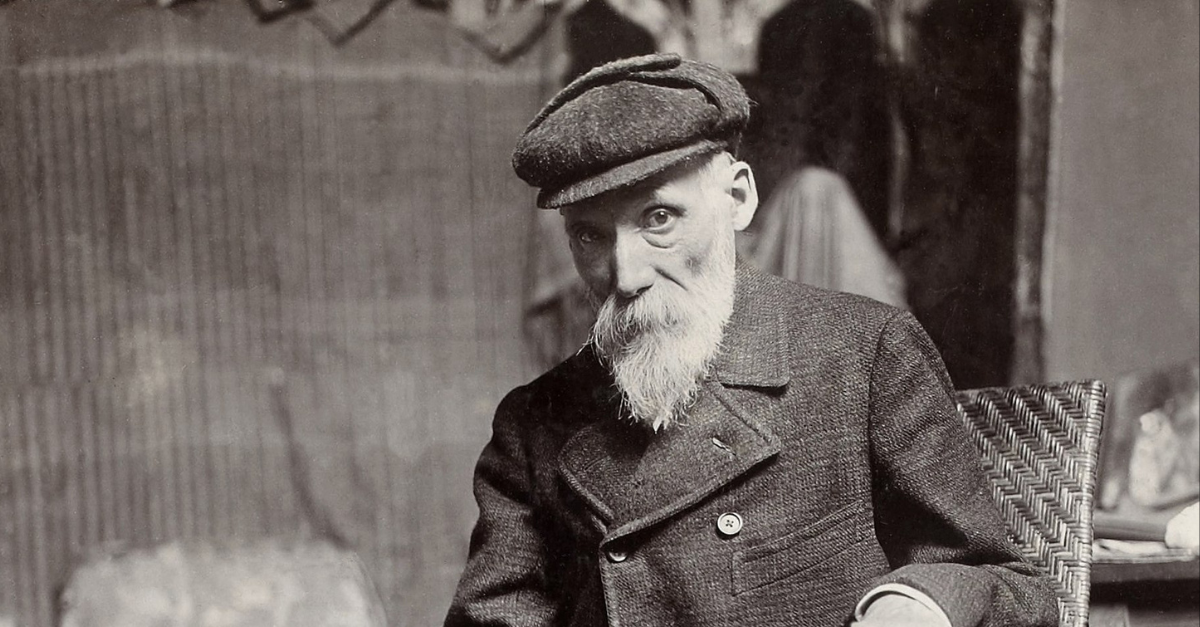

It’s the kind of story you’d expect from a movie script, not a museum logbook. A long-lost Renoir—stolen from the Baltimore Museum of Art in the early 1950s—vanishes for over six decades, only to pop up at a flea market in West Virginia for the low, low price of seven bucks. It’s a tale of luck, loss, and the laws that keep art where it belongs.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team